Global manufacturing industry growth reached 3.8% in 2022

03.02.2023

• Machinery sector growth outperformed manufacturing in 2022.

• Americas region to grow by 3.1% in 2023.

• Germany and the UK experiencing significant challenges in current economic climate.

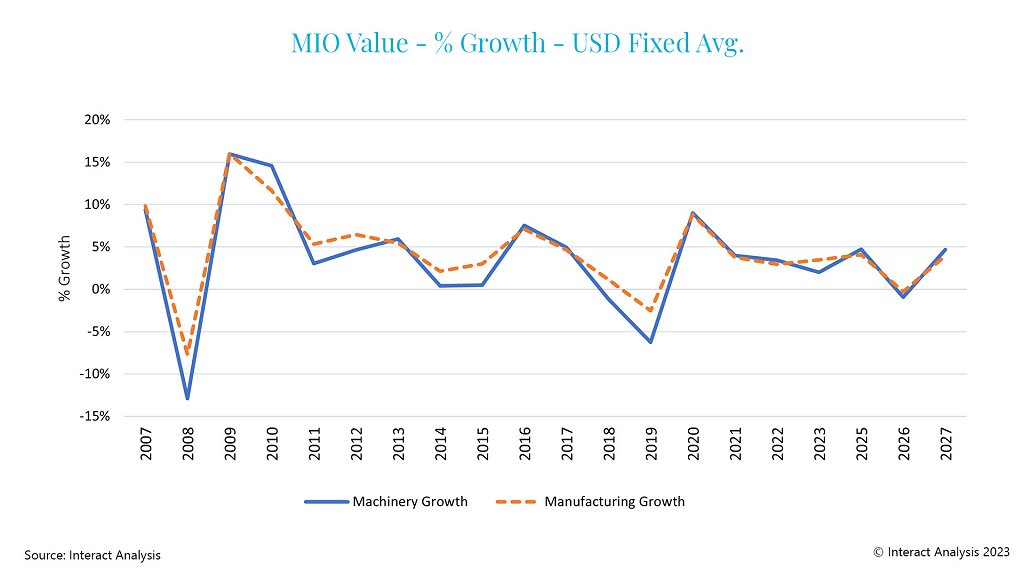

Updated research by Interact Analysis shows that Asia Pacific (APAC), Europe and the US have performed very differently in terms of manufacturing output growth during 2022. Growth in Europe has been slow throughout the year, while it has been strong in the US and steady in APAC. Machinery sectors have performed better than the manufacturing sector overall, and despite current challenges the next global downturn for manufacturing is not expected until late 2025 or early 2026.

The next manufacturing downturn is expected in 2026, but to a lesser extent than in 2020.

The next manufacturing downturn is expected in 2026, but to a lesser extent than in 2020.

Regionally, the US manufacturing industry has performed strongly, and the Americas growth rate hit 6.9% in 2022, compared to 3.3% for Asia Pacific and 2.6% for Europe. However, due to economic weaknesses across the regions, the Americas region is only forecast growth of 3.1% in 2023. Despite ongoing supply chain issues and inflationary pressures, it is expected that overall global manufacturing industry output growth reached 3.8% in 2022.

The UK and Germany are suffering a particularly bad economic period due to Germany’s reliance on Russian energy and the UK’s current political turbulence. Germany also strongly relies on other countries for its exports that are experiencing similar difficulties. Despite this, some sectors are still performing well in Germany, including forming machinery, where order intake grew by 7% in 2022 due to strong export demand. Overall, German growth was slow, sitting at around 0.2% for 2022, while in the UK, the situation is similarly gloomy. For the second year in three, manufacturing production has shrunk by around 0.5%, forcing the UK into a negative forecast for 2022. Many smaller regions had propped up Europe in terms of the region’s overall performance.

In contrast, the outlook for China remains positive, with 2023 to 2025 anticipated to be a period of growth and recovery for the country. As a result of further COVID-19 lockdowns, manufacturing output weakened, with growth contracting to 2.9% in 2022. The predicted recessions across the US and Europe are expected to slow growth again in 2026, falling to similar rates to those seen in 2020 when the COVID-19 pandemic struck. In China, the highest growth rates in 2022 were seen in the chemicals and pharmaceuticals industry, which grew by 4.9%. Conversely, wood products registered the lowest growth rate, declining by -1.7%.

Adrian Lloyd, CEO at Interact Analysis, adds, “The COVID-19 pandemic has had an undoubted impact on the world and many regions, especially China, are still suffering from the aftereffects. This, coupled with rising interest rates, inflation and supply chain constraints, have created the perfect storm. In Europe, the UK and Germany are perhaps suffering the most and this is expected to continue for the next few years. The situation in the US seems to be a little rosier, where growth in 2022 reached 8.7% for manufacturing, and 12% for machinery production overall.”

About the Report:

In a fast-moving sector with complex correlations, it is critical to understand the state of the market now, where it was, and where it will be. This report quantifies the total value of manufacturing production with deep granularity – covering 102 industries, sub-industries and machinery sectors, across 44 countries, and presenting 15 years of historical data alongside a credible 5-year forecast.

We’ve carefully organized the country data around a common taxonomy to provide easy-to-interrogate, like-for-like comparisons. Credible five-years forecasts round out the view.

To learn more, visit www.InteractAnalysis.com